Ideas for Doing Christmas and New Year on a Budget

The contents provided on this page are for informational purposes only and do not constitute financial advice.

November kicks off the busiest time of the year for shopping and spending as we head into the festive season. From Black Friday sales and Cyber Monday deals, to Christmas gifts and end-of-year parties, you might feel overwhelmed by the thought of these upcoming events and the expenses that come with it.

We’ve come up with a few ways to help you stay in control of your finances this festive season, whether you’re looking to cut back to stay within your budget, or want some savvy spending tips.

With a little creativity and organisation you can do Christmas on a budget and still make the most of it with these tips.

- Shop deals

- Create lists and spending limits

- Try to avoid or minimise using credit cards

- Gift creatively

- Save on shipping costs

1. Shop deals

Create a budget for the expenses you need to cover for Christmas, including food, gifts, decorations and any travel plans. Then take advantage of Black Friday (Friday 25 November 2022), Cyber Monday (Monday 28 November 2022) and other seasonal sales to save money, with some retailers offering deals and discounts of up to 80% off.

Consider browsing upcoming deals ahead of the big sales to help you prepare and avoid buying things you don’t actually want or need! Plus, with Salesforce forecasting that 25% of Australians are set to finish their Christmas shopping during Black Friday sales, it’s bound to get busy.

Check out these websites for a list of upcoming deals and discounts while tracking your expenses with Beforepay’s budgeting tool:

2. Create lists and spending limits

If you’re shopping for gifts…

Create a list of who you’re shopping for and how much you can spend on each person’s gift while staying within your means.

Despite the rising cost of living, research by Roy Morgan suggests spending won’t be slowing down over Christmas, with Australians predicted to spend almost $64 billion this year, up 3% on last year.

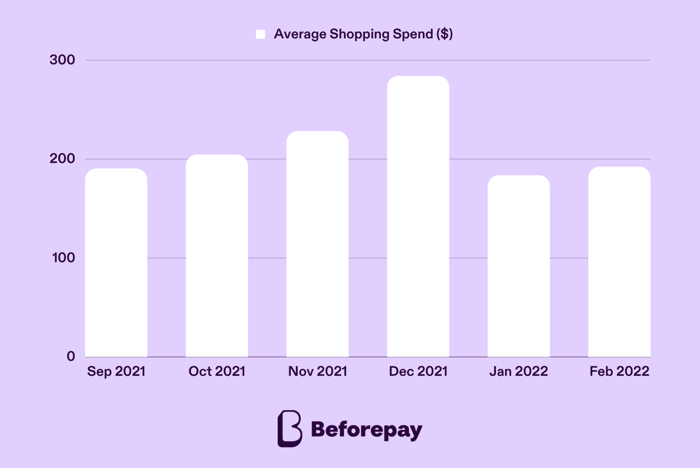

Beforepay data from more than 300,000 people suggests the same increase over the festive season, with spending insights from last year showing a 49% jump between September and December 2021. The average spending for shopping rose from $190.13 in September 2021 to a high of $283.74 in December 2021, before dropping again to normal levels in January and February.

Being organised will help you stay on track so you’re not spending more than you can afford, and avoid falling into a revolving debt spiral. If you’re shopping online try filtering items by price, or using gift guides by price that some retailers curate, like this one from Westfield, to help you stick to your spending limit.

If you’re hosting this year’s summer BBQ or New Year’s Eve party…

Create a list of the food you want to prepare and the ingredients you will need, along with the maximum amount you can afford to spend. Then plan your grocery shop according to your budget.

Bonus tip: Substitute brand name ingredients with affordable alternatives to help you save a little extra.

You can also consider sharing the load and asking each of your guests to bring a plate, taking away the pressure of preparing multiple dishes. Want to add some fun and creativity? Ask people to bring in dishes according to a theme for a laugh, like dishes with red ingredients, or dishes that start with the first letter of their name!

If you’re planning a school holiday getaway with the family…

Create a list of the expenses you need to budget for, like accommodation and flights or petrol if you plan to drive. Then figure out how much you can afford to spend without compromising your cashflow and budget for regular living expenses. This will help you focus your search on destinations and travel deals that are within your spending limit.

Try looking for discounted flights and package deals to save money where you can. Here are a few to get you started:

Looking for a way to keep the kids occupied? Check your destination for free attractions nearby, or browse websites like Klook for discounted experiences in the area.

3. Try to avoid or minimise using credit cards

With expenses piling up around Christmas, it can be easy and tempting to put all your shopping, party expenses and holiday plans on your credit card to secure your purchases.

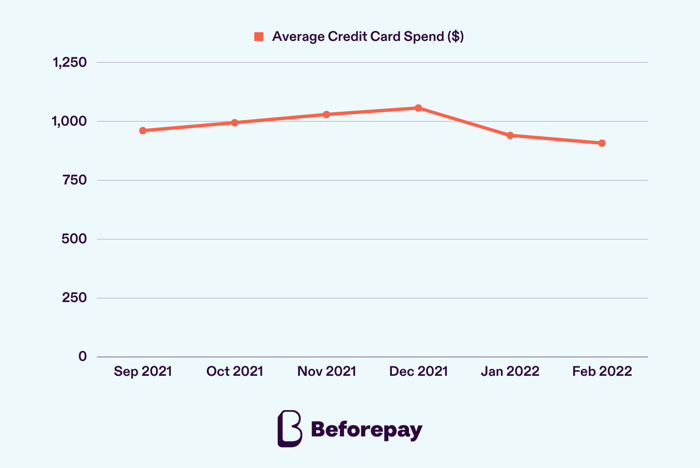

Beforepay data for more than 300,000 people revealed credit card expenses grew over the festive season, with Australians spending an average of $960.39 on credit cards in September 2021 before rising to $1029.20 in November 2021 and $1056.80 in December 2021. Credit card spending slowed post-Christmas, dropping to an average of $940.06 in January 2022, and again to $907.22 in February 2022.

Using credit cards for all your Christmas shopping can come with the risk of a revolving debt trap if you lose track of how much you’re putting on your credit card and spend more than you can afford to pay back.

For instance, if your post-Christmas shopping bill arrives and you can only afford to pay your minimum monthly repayment, you could end up paying more in interest charges and spending months trying to get your credit card debt back under control.

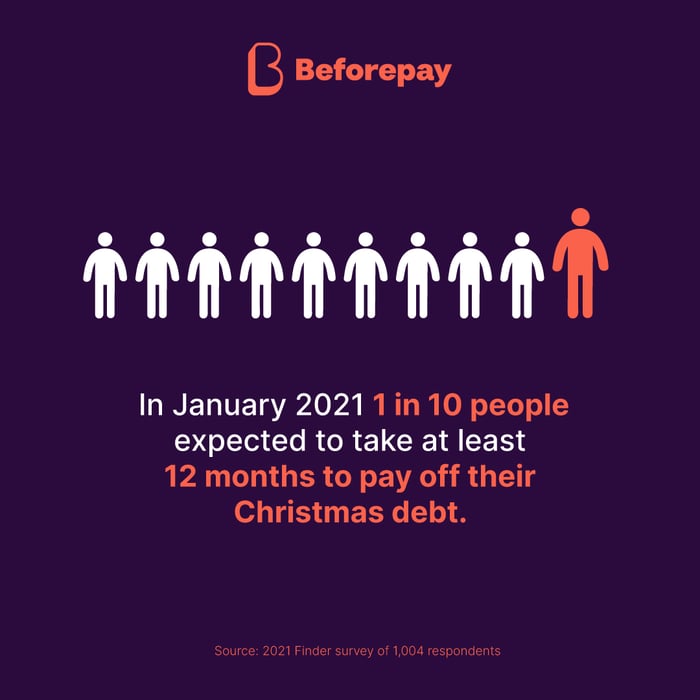

In January 2021 Finder surveyed 1,004 people and found only 35% of people had paid off their debt at the time, with one in ten people expecting to take at least 12 months to pay off their Christmas debt.

Creating a shopping budget based on your income and savings makes it easier to keep track of your expenses and spend within your means. Opting to boost your Christmas budget with Beforepay Pay Advance can also be a more cost-effective alternative to using your credit card for your Christmas expenses. Beforepay is available on public holidays and offers transparent pricing (so you always know what you owe) and flexible repayments.

If you do decide to use your credit card, make sure you monitor your transactions so you only spend what you can afford to repay and don’t run the risk of revolving debt.

4. Gift creatively

If you exchange gifts over the festive season, maybe with work or with family and friends, buying a gift for every person can add up and become very expensive, very quickly. An alternative gift-giving arrangement can help everyone save money and manage the pressures that come with the season of giving.

Here are some ideas you can try.

Buy gifts secondhand

One of the most obvious and well-known benefits of shopping secondhand is the savings. You can often find pre-loved goods up to 50% cheaper than you could elsewhere!

Vintage stores are great for finding old books, wooden toys and beautiful baubles. As well as helping you save money, buying second-hand gifts can also help the environment.

Organise a Secret Santa

Spending $50 on one gift instead of $30 each on 10 gifts can see you saving $250! And you get to avoid the stress of shopping for multiple gifts.

Free online tools like Elfster and DrawNames make it easy to coordinate your Secret Santa. Or you can go classic and have some fun drawing names out of a hat!

DIY Christmas gifts

Create something personalised and sentimental with a do-it-yourself (DIY) gift, like a framed photo or a hamper of their favourite snacks. You could even have everyone exchanging only DIY gifts they’ve prepared themselves!

Make a Christmas donation

You can donate to your friend or family member’s favourite cause or charity in their name for a different type of gift. Remember to keep your receipt so you can claim this in next year’s tax return, as long as your donation is $2 or more and made to an organisation with a deductible gift recipient or DGR status.

5. Save on shipping costs

Some online retailers may offer you free shipping if you spend a certain amount, which is a great perk! But what if, for example, you had to spend $150 for free shipping, but the item you had in mind was only $50? You’ll either pay the shipping cost or spend extra on things you didn’t actually need to get the free shipping.

Here are some things to consider to help you be savvy with your online shopping and shipping.

Group your Christmas shopping orders

Buy everything you need from one place to avoid paying extra for shipping with multiple retailers. Or coordinate a shop with a friend or family member so your combined purchase can qualify for free shipping. That way you both win!

Opt for digital gifts

Stuck on gift ideas? Use websites like eGift Australia or Prezzee to send an electronic gift card so they can buy whatever they want, taking out the stress of shopping, shipping and Christmas crowds!

Pick up your gifts from the store

A lot of retailers and major grocery stores now offer click-and-collect services, which means you can still enjoy the ease and convenience of online shopping without having to worry about delivery fees and minimum spends.

Check delivery cut-off dates

Getting your orders in early can help you avoid paying extra for express delivery on online purchases to ensure they get to you on time. Most retailers will provide you with an estimated delivery date so you can check this before placing your order. You can also check the Australia Post website for cut-off dates. The earlier the better!

Disclaimer: Beforepay Group Ltd, ABN: 63 6933 925 505. Beforepay allows eligible customers to access their pay and provides budgeting tools. Beforepay does not provide financial products, financial advice or credit products. The views provided in this article include factual information and the personal opinions of relevant Beforepay staff and do not constitute financial advice. Beforepay and its related bodies corporate make no representation or warranty, express or implied, as to the accuracy, completeness, timeliness or reliability of the contents of this blog post and do not accept any liability for any loss whatsoever arising from the use of this information. Please read our Terms of Service carefully before deciding whether to use any of our services.

.png)

%20(505%20x%20320%20px)%20(8).png)

%20(505%20x%20320%20px)%20(2).png)