Self-Care and Valentine’s Day on a Budget

According to the latest Scamwatch report, Aussies lost a whopping $40 million in Valentine’s Day scams in 2022. Whether you're planning on celebrating Valentine’s Day with family, loved ones or pets, staying alert for suspicious text messages or emails can help you avoid losing your money to these scams!

In this edition of The Beforepay Beat:

- Need some affordable ways to celebrate Valentine’s Day? We’ve got you.

- Learn how to spot a romance scammer

- Self-care and financial independence on a budget

MONEY TIPS

Ideas for a budget-friendly Valentine's Day

Who says Valentine’s Day has to cost a fortune to be fun and memorable?

We’re all still navigating rising costs, so to ease the stress and pressure we’ve created a list of Valentine’s Day ideas to help you make the most of the day (or however long you want to celebrate!) without breaking the bank.

Take the stress off your wallet and focus on spending time with your loved ones with these affordable Valentine’s Day ideas!

We’ve even created checklists to help you organise each activity! Check it out, and more ideas, in our latest blog.

Learn more

IN THE COMMUNITY

Sydney shares their money tips

If your love language is quality time these Valentine's Day ideas might be perfect for you.

Tap the image below to get some inspiration!

MONEY SAFETY

How to spot a Valentine’s Day scam

Last year romance scams accounted for a third of all scams reported. So we're here to help you stay one step ahead!

Scams during Valentine’s Day are more common than you might think and can take various forms, including fake dating profiles and text or email messages impersonating loved ones.

Here are some typical signs that could help you pick out a Valentine’s Day scam from an actual message!

- Unexpected messages - Be cautious of unexpected calls, emails, text or social media messages.

- Urgency and pressure - Scammers may create urgency to exploit emotions or push for personal information quickly.

- Unsolicited romantic gestures - Be on the lookout for unexpected gifts or gestures, especially if they come with requests for personal information.

- Secure communication - Be cautious if new romantic interests insist on unconventional or untraceable communication.

Need a refresher on how to keep safe from scams and hackers? Check out our cybersecurity blog.

See more

MONEY TIPS

Simple steps to financial independence and self-care

Did you know that working towards financial independence is also a way to show yourself some love?

However, reaching financial independence takes effort. Here are some simple steps to help you get there:

- Set and keep track of your budget - Make a plan for your money and check it regularly to make sure you're staying on track.

- Develop healthy money habits - Save, spend wisely, and make thoughtful financial decisions.

- Plan some me-time each month - Invest in your hobbies to curb impulse shopping and avoid unplanned spending.

For more ideas on how to manage your financial wellbeing check out our blog.

See more

INSIGHTS

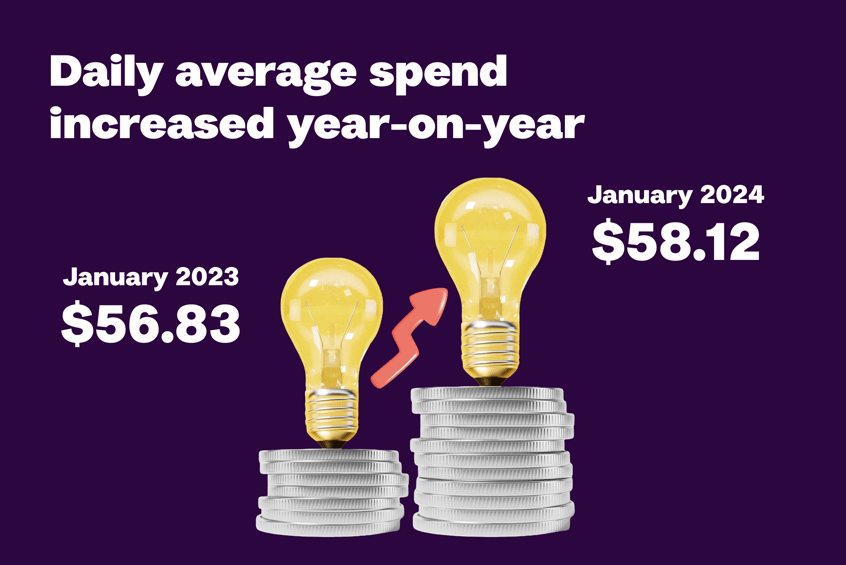

Aussies' average daily spending drops post-holidays

According to the latest Beforepay Cost of Living Index the average daily spend went up by 2.3% year-on-year. Month-on-month the figure declined 10.2% to $58.12 in January from $64.69 in December.

Spending in key household categories tracked decreased in January, with the exception of utilities which increased 1.3% to $6.10 from $6.02.

To keep up with changing costs, here are some shopping tips you could try to help you stick to your grocery budget!

- Compare supermarket prices before shopping

- Stick to your shopping list

- Sign up to a reward program for weekly deals and specials

- Buy no-brand groceries

- Buy sale items in bulk

For more tips visit the Beforepay blog.

See more

QUICK LINKS

- Looking for ways you could earn more money? Check out these 4 steps that could help boost your salary!

- February is here and it's not too late to set some goals and resolutions! Use our list of financial resolutions to get you moving

- Looking for assistance to help you save money? Use these resources to help you manage your money on a low income

- For support with your finances see our list of resources on our website.

- Need help with your Beforepay account? Visit our Help Centre or contact our Customer Support team at support@beforepay.com.au.

WE 🧡 OUR CUSTOMERS

-4.png)

-2.png)