Ways You Could Make Extra Money Without Quitting Your Job

You’ve probably caught yourself thinking about how to make a little extra money, right? The great thing is – it doesn’t have to be hard, and it doesn’t have to take up too much time.

We’re breaking it down so you can see how quick and easy it can be to set yourself up with extra funds!

In this edition of The Beforepay Beat:

- Simple and stress-free ways to make extra cash

- Fun Fact: How a spare mattress led to a million dollar business

- Things you could rent out to make some extra money

- Cost of living changes in July: Tax season drives 10.6% spending increase

MONEY TIPS

Simple and stress-free ways to make extra money

You may be thinking It sounds too good to be true. Right? But there are many opportunities for you to earn extra money without quitting your main job!

Not sure where to begin? You could start by looking at opportunities to grow your money, or by turning your skills and interests into hobbies that make you a little extra money on the side.

Whatever you decide to do, it’s important you choose what works for you and your current circumstances.

Here are some ideas to get you thinking:

- Consider opening a high interest savings account

- Offer home organisation services

- Online tutoring

- Teaching musical instruments

- Sporting coach

- Sell locally produced goods

See more

FUN FACT

Airbnb started from two guys renting out their air mattresses!

(Source)

Brian Chesky and Joe Gebbie just thought they were offering a helping hand when they decided to rent out air mattresses to conference attendees because nearby hotels were booked out. Now, 10 years later, their idea is the US $1 billion business we all know as Airbnb.

Now, not all ideas will turn into billion dollar businesses, but take this as inspiration for creative ways you could make some extra money!

MONEY TIPS

Tips for building up your savings

Around 1 in 4 Australians find it difficult to manage their expenses on their current income, according to a report by the Australian National University.

Having a source of extra funds could help reduce financial stress. Whether through a side hustle or an emergency fund, this could give you the financial cushion and extra savings to handle whatever life throws your way without impacting your current budget or cash flow.

However you decide to boost your savings, these are some useful tips you could consider:

- Assess your expenses to understand how much extra you could be saving.

- Set a goal to break down how much you can put aside regularly.

- Create a budget to stay on track with spending and saving.

- Automate your savings to make saving easy!

See more

MONEY TIPS

How renting out your things could be a source of extra cash

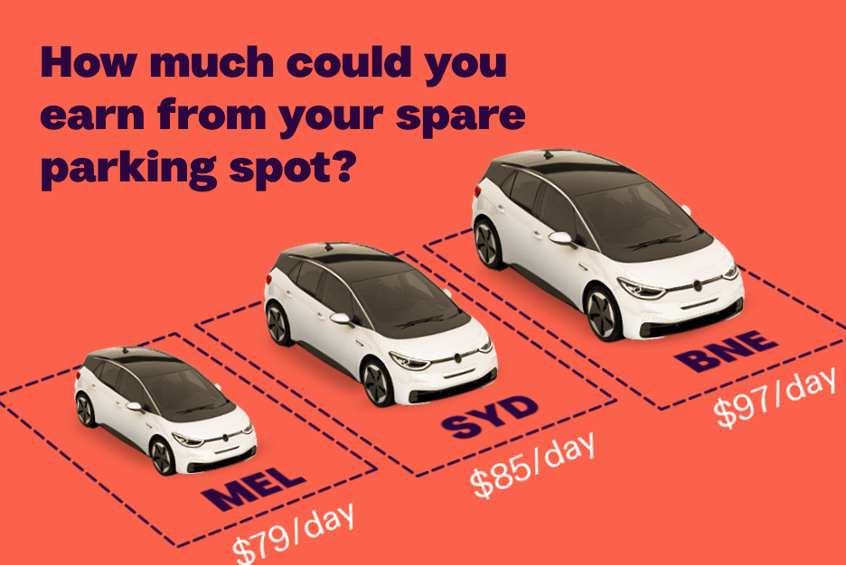

Did you know the average cost of daily off-street parking in the Brisbane CBD could be as high as $97/day? That’s according to Parkhound, which also found that in Melbourne this could reach up to $79/day, and up to $85/day in Sydney.

All this is to say, if you have a spare parking spot, you could potentially boost your savings by renting it out for the week!

Renting out your things can be a great way to earn extra money. You won’t need to purchase anything new to get started and can give your finances an extra boost while giving other people access to things they only need temporarily – win-win!

Other common things you could consider renting out are a spare room in your place, your tools, camera equipment or clothes.

Find out what else and see how you could start renting out your things for some extra savings!

Learn more

INSIGHTS

Tax season drives 10.6% spending increase in July 2023

Aussies seemed to bump up their spending last month as average daily spending increased to $65.13, up from $58.88 in June, according to the July 2023 Cost of Living Index.

Durable goods, which includes items such as electronics and whitegoods, saw the largest increase. Spending increased 23.4% from an average daily spend of $6.55 in June to $8.08 in July.

Other notable increases were seen in discretionary spending categories. July saw Australians spend more on entertainment and leisure and food and drink.

How does your July spending compare? Check out our latest Cost of Living Index release to find out more.

See more

BEFOREPAY TIP

.png?width=846&height=566&name=3%20(2).png)

Reminder: How to access Tax Refund Advance

If you lodge your tax return with a participating H&R Block office, you could be eligible for a Tax Refund Advance with Beforepay.

Here are 3 things to remember about accessing Tax Refund Advance!

- You must lodge your tax return with a participating H&R Block Australia office and use their Fee From Refund product.

- Your H&R Block consultant needs to verify your eligibility for a Tax Refund Advance once your return has been lodged.

- You need to register or log in to your Beforepay account to verify your eligibility with Beforepay and unlock your Tax Refund Advance.

Find out more

WE 🧡 OUR CUSTOMERS

.png?width=691&height=462&name=Social%20Proof%20(1).png)

.png)

-3.png)

%20(1440x441)%20(3)-1.png)