Prepare for the Unexpected With an Emergency Fund

Whether it’s you or a loved one overseas who could do with a financial boost, being prepared with an emergency fund could help you or your loved ones get back on your feet quicker.

In this edition of The Beforepay Beat:

- What use is an emergency fund? We’ve got 4!

- How the monthly cost of living increased 2.9% in April

- Thoughts from a self-made billionaire about emergency funds

- Boost your transfer: Send more with Beforepay and Western Union

- Feature update! Repayments are even easier

MONEY TIP

Send more money to loved ones overseas with Beforepay and Western Union

With almost 30% of Australia’s population born overseas, more people than ever are sending money abroad to support friends and family.

To help you stay prepared for whatever unexpected expenses pop up, here or overseas, Beforepay has teamed up with Western Union so you can boost your transfer and send more money to your loved ones when you need to!

This can come in handy to help pay for things like bills, school fees and emergency costs in the event of medical expenses or natural disasters.

Visit the Western Union website to find out more and set up your Western Union account to get started.

Find out more

FUN FACT

Even self-made billionaires believe in the value of having an emergency fund!

John Paul DeJoria, for example, was born into a poor immigrant family and became a billionaire through several business ventures. When asked what advice he would give to his younger self, he said having an emergency fund is key to being prepared if things don’t go to plan.

"It’s important to have a cushion of six months financial backup before you invest or if something doesn’t work out in your favour."

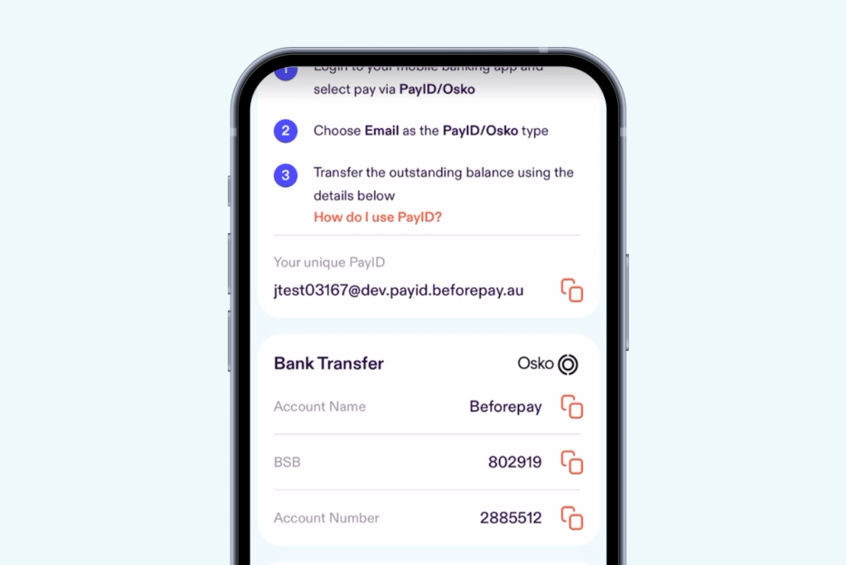

FEATURE UPDATE

PayID with Beforepay is changing

Making your early (or late) repayments is now easier than ever!

You now have your own personalised PayID/Osko address that is unique to you for making repayments (update your app to see the new functionality!).

Here’s a quick breakdown about what this means for you.

What’s new

- You now have a unique PayID address that you can use (and save) to make repayments via PayID.

- If PayID is not available for your bank, you will have a unique BSB and Account Number you can pay into.

- You can save any of these in your internet banking, making it more convenient for next time!

What’s changed

- You can no longer make payments to payments@beforepay.com.au.

- You no longer need to enter a reference number.

Don’t worry, the changes shouldn’t impact any recent payments, but you can always contact us on support@beforepay.com.au if you have any questions.

If it’s your first time accessing PayID it may take up to 30 seconds to generate your unique PayID details.

Log in to Beforepay to see your new PayID details.

MONEY TIP

4 things an emergency fund could help you with

Wondering why you should have an emergency fund? Here are just a few things your emergency fund could help you with!

1. Unexpected expenses - to help soften the blow of expenses you haven’t budgeted for.

2. Job loss - to give you some breathing room while searching for new opportunities.

3. Medical expenses - to help reduce the financial pressure of hefty and unpredictable healthcare.

4. Financial wellbeing - to give you the confidence to handle whatever life throws your way without going into long-term, revolving debt.

Building an emergency fund doesn’t happen overnight. Work towards it steadily – assess your expenses, set a goal and think about automating your savings.

See more about these quick and easy steps for building and growing your emergency fund.

See more

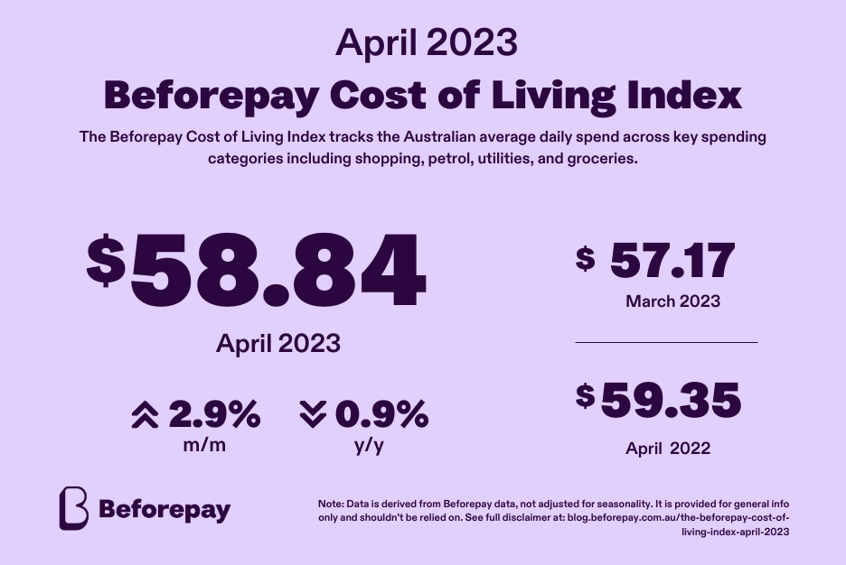

INSIGHTS

Retail spending drives 2.9% monthly increase in cost of living.

The average daily spend for Australians rose by 2.9% from $57.17 to $58.84 in April, according to the April 2023 Beforepay Cost of Living Index.

Discretionary expenses were the major contributors to the increase in average daily spending.

Other insights:

- Shopping and durable shopping rose 7.8% and 7.7% respectively month-on-month.

- Utilities spend fell 0.8% in April to $5.96 from $6.01 in March, but remains 18.7% above the level one year ago.

- Fitness and health expenses saw a spike in April spending, up 4.3% to $2.44 from $2.34 in March.

- Spending on groceries was up 1.2% to $15.24 from $15.06 in March, while petrol and auto spending dropped 0.3% month-on-month to $7.85 from $7.87.

See more

MONEY TIP

How a pay advance can help with money transfers

If you need to send an international money transfer, accessing extra funds with a product like a Beforepay Pay Advance can help you top up your transfer and/or send money when you need to.

Some other perks that can come with using a pay advance to boost your money transfer include:

- Quick and easy - generally fast and simple to set up.

- Transparent pricing - no surprises, no hidden costs.

- Convenience - funds ready in your account to send when you need to.

- No long-term commitment

Learn more and find out how you can send more to loved ones overseas with Beforepay and Western Union.

See more

WE 🧡 OUR CUSTOMERS

%20(1)-1.png?width=786&height=526&name=2023_Newsletter-Images%20(936%20x%20626)%20(1)-1.png)

.png)

-1.png?width=846&height=566&name=2023_Newsletter-Images%20(936%20x%20626)-1.png)

-1.png)

-1.png)