Get to Financial Independence with These Tips

Dreaming of owning a house and car, paying off your loans and having a healthy savings account you can count on when life happens? You’re not alone! Achieving financial independence is the ultimate goal for a lot of people, so let’s look at different ways you can make this happen.

In this edition of The Beforepay Beat:

- How to feel confident about your finances

- Bet you didn’t know this fun fact about Australia’s first ATM!

- 6 ways to keep your debt in check and under control

- Cost of living: Utilities prices continue to drive up living expenses

MONEY TIPS

The secret to being confident with your finances? Know how your money moves!

In 2021, ANZ conducted a Financial Wellbeing Survey that revealed having a strong financial knowledge can help you feel more confident and in control of your money.

Basically, know how your money moves so you can feel confident that you’re making smart, informed decisions about how you spend and save!

Staying on top of your finances now can put you in a better position to achieve financial independence later, like being able to put aside savings that will help you buy your first car or home.

Here are some things to think about to help you on your way to feeling confident and in control of your finances.

2. Find a budgeting app that works for you

3. Avoid or minimise debt where possible

4. Keep an emergency fund.

Find out more

FUN FACT

Australia's first ATM in 1969 allowed customers to cash out $25!

Source

The machine was an exciting innovation at the time, offering Australians a new way to access quick cash. The process was not entirely instant though. After cashing out, customers still had to wait for their cards to be mailed back to them, rather than having the machine spit it back out.

And if they wanted more than $25, they had to talk to their banks!

BEFOREPAY TIP

Remember to check your repayment schedule!

Getting into the habit of checking your repayment schedule is a good way to stay on top of your finances. Here’s why:

- You can anticipate when your repayments will be debited from your account.

- It gives you time to budget and plan your finances against your other upcoming expenses.

- You can see ahead of time if a scheduled repayment date doesn’t align with your upcoming payday.

- It gives you enough time to delay your repayment if you need to, using the ‘Delay repayment’ button in the app, or contact us if you encounter any issues.

So if you’ve cashed out with us, make sure to check your repayment schedule in the Beforepay app!

Questions? Email us at support@beforepay.com.au

MONEY TIPS

6 ways you can manage your debt

Debt isn’t always a bad thing. For instance, debt can be useful for helping you achieve some pretty big milestones in life, like completing your degree, buying your first home or starting a business.

Being able to manage your debt well is what can help you stay on the path of being financially independent and in control.

We spoke to Loan Options, Australia’s first AI-powered loan comparison platform, to look at some things you can try to help manage your debt:

2. Pay off your credit card balance in full every month – what are the benefits you can reap later.

3. Set financial goals – how these can be a source of motivation.

4. Consolidate your debts – what does this mean and how it can help.

5. Shop around for the best rates – how to find the best loan options for you.

6. Be vigilant – things to be aware of when exploring your financial options.

Learn more about these 6 simple practices and how you might be able to use them to help you manage your debt.

Find out more

INSIGHTS

Utilities prices continue to drive up living expenses

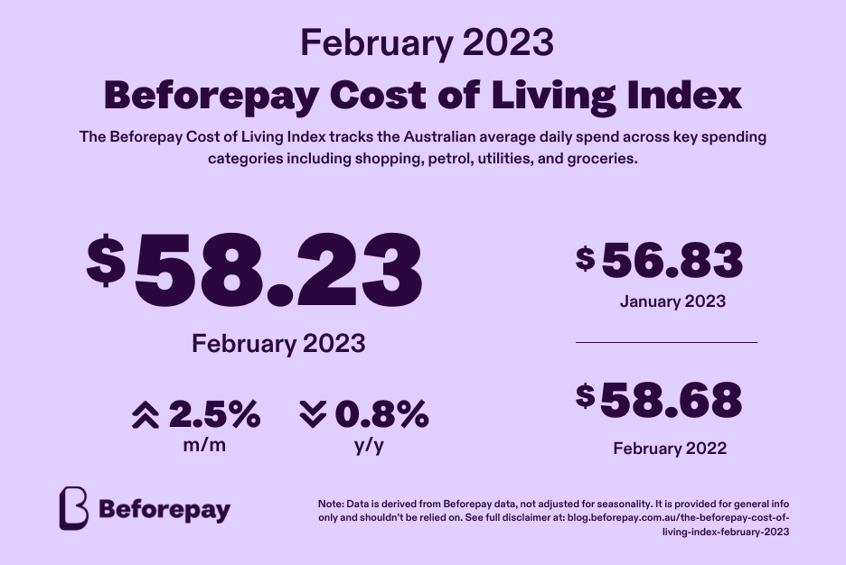

The average daily cost of living is up 2.5% from $56.83 in January to $58.23 in February, according to the Beforepay Cost of Living Index.

The rise is led by increases in utilities expenses, with data from more than 350,000 Australians showing a jump from a daily average of $5.80 in January to $6.18 in February. This continues a significant increase, with daily utility spend only $5.31 in February 2022.

To help manage your expenses, compare how much you could save on your broadband internet or gas and electricity with Beforepay’s Compare and Save platform.

See our latest Cost of Living update for more insights.

Find out more

WE 🧡 OUR CUSTOMERS

.png)

.png)

%20(1440x441)%20(1).png)