Salary Boosting Strategies & Popular Ways to Spend on Valentine’s Day

And just like that it’s February – not too late to set some goals and resolutions, and not too early to get things moving!

Whether you’re looking to make a career change, learn some new skills or simply improve your financial situation we’ve got tips to help you put your best foot forward in 2023.

In this edition of The Beforepay Beat:

- Want to earn more? Try these tips for increasing your salary.

- A snapshot of spending on Valentine’s Day

- Where the cost of living stands in the new year

- Can you guess which jobs and skills are in demand for 2023?

- A 7-day savings challenge to kickstart your financial goals

MONEY TIPS

How to ask for a raise (and other tips for increasing your salary)

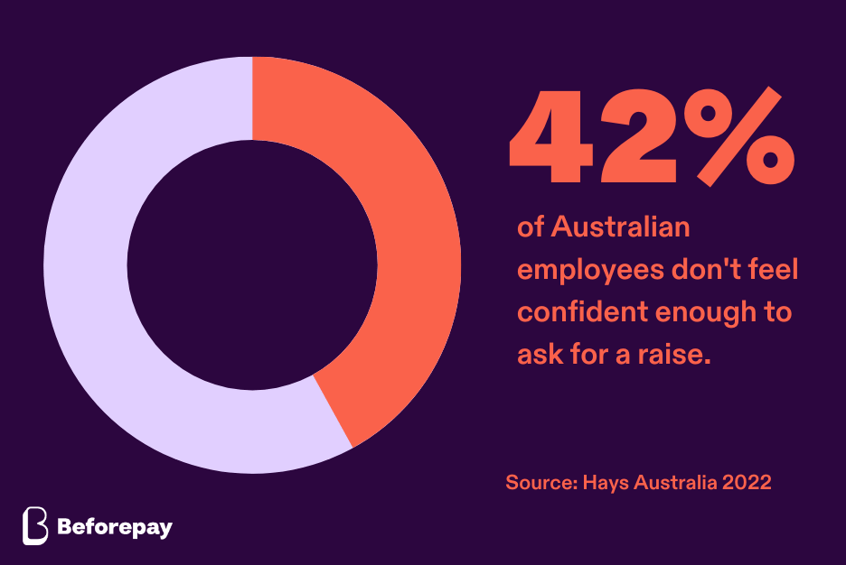

Hang on to that new year motivation and think about taking some steps to increase your salary, like asking your employer for a raise.

Having the confidence to ask is the first step to unlocking possibilities to expand your earning potential and improve your financial situation, so we’ve got some tips to help you prepare and give it a go!

1. Gather your research. Why do you deserve a raise? Have your responsibilities evolved since you started? How does your salary compare to similar jobs in your industry? Use free online salary checkers, like Hays Australia Salary Checker and Seek lookup tool. This can also help you find out an appropriate amount to be asking for.

2. Practise your pitch. Practising can not only ensure you are prepared, but can also help you feel confident in your abilities and your ask.

3. Have an open conversation. Highlight your key achievements and the unique value you can bring to your workplace, like diverse experiences and ways of thinking.

4. Be flexible. Be prepared to compromise and discuss alternatives to a salary increase, such as flexible work arrangements. Negotiation is two-way, and your employer will need to consider what will work best for them as well.

Visit our blog for tips on other things you can consider to help increase your salary, like learning new skills or looking for a new job!

Find out more

FUN FACT

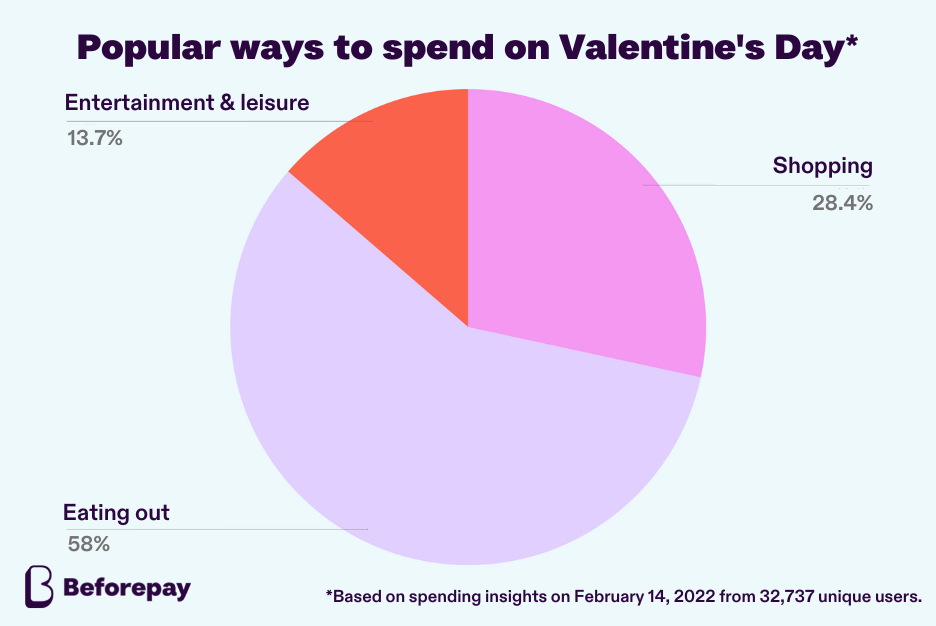

Looks like grabbing a bite and shopping for gifts are the top ways Beforepay users like to spend Valentine’s Day!

Based on spending insights from 32,737 users on February 14, 2022, Beforepay users are likely to spend the most on food and eating out on Valentine’s Day, spending an average of $95.98 per person. Shopping came in second with users spending an average of $60.97 each on gifts.

Roy Morgan estimated that Australians would spend AU$415 million on Valentine’s Day gifts in 2022!

Whether you’re spoiling your special someone to a fancy meal or indulging in some self-care, you can always boost your Valentine’s Day plans with Beforepay.

Get prepared now and cash out a Pay Advance ahead of Valentine’s Day!

INSIGHTS

Looking for a new job? These skills are in demand!

91% of employers in Australia are experiencing a skills shortage, making now the perfect time to consider upskilling or switching jobs to unlock more career opportunities and a higher income.

To help you narrow your search we looked at reports from Hays Australia, TAFE and Victoria University to find out what some of the most in-demand skills and jobs are for 2023, so you don’t have to!

We’ve listed some of the top skills and jobs above–check out the links above or list below for other in-demand skills and jobs for 2023.

- Payroll Officer

- Early Childhood Teacher and Child Care Worker

- Facilities Manager

- Industrial Development Manager

- Contact Centre Worker

- Labourer

- Truck Driver

Learn more about where you can go to upskill and tips for applying for a new job.

Find out more

BEFOREPAY TIP

Have your employment circumstances changed? Tell us!

Did you know a change in your income can impact how much you can borrow?

Having a regular income (weekly, fortnightly, monthly) of over $300 a week after tax is one of the factors that helps us determine your eligibility to cash out with Beforepay, as well as how much you can borrow.

That means, if our system can no longer detect your pay cycle, there is a chance this might cause your limit to decrease.

Some scenarios in which we might not be able to detect your pay cycle might be:

- You're in between jobs and are waiting for your first pay from your new job.

- You've changed the bank account your salary goes into.

So if you’re going through some changes, particularly when it comes to your employment, make sure you contact us to keep your account up-to-date!

MONEY TIP

Did you know that only 63% of students in 2022 were aged between 15 and 24? (ABS 2022)

Learning is a lifelong experience and can also provide you with the pathway to a new career and/or higher salary.

If you or people you know are thinking about taking up further education to help progress your career, you also know how it can come with a significant financial investment.

To help with this, there are a range of special loans offered to those wanting to study in Australia, in addition to a wide range of short courses.

But before applying for a study loan, it’s good to understand your options. Not sure where to start? We’ve got you, with our list of 8 questions to help you determine which study option is right for you.

- What is a HELP loan?

- Am I eligible for a HELP loan?

- What type of HELP loan will I need?

- How do I apply for a HELP loan?

- How much will my loan cost me?

- How and when will I pay my loan back?

- What other types of study expenses should I keep in mind?

- What if a HELP loan isn’t right for me?

Check out our blog to unpack each question!

Find out more

INSIGHTS

Australian household spending falls in January 2023

The average daily cost of living fell by 8% month on month from $62.02 in December 2022 to $56.83 in January 2023. Year on year this figure increased by 1.6% from $55.95 in January 2022.

The largest decrease in spending was seen in the shopping category, with a 34% reduction from $9.73 to $6.44. Durable spend also fell by 11% from $6.84 to $6.08, while groceries remained unchanged at $15.27 per day.

Find out more

MONEY TIP

A 7-day savings challenge to kickstart positive money habits

Maybe you’re totally content with your job and career right now. Maybe your financial goals (or resolutions) are less about your job and more about getting better at managing your money. And that’s perfectly okay! We want to support your financial journey, whatever your goals and priorities.

To get started, you might want to try our 7-day savings challenge - a quick and easy way to try different ways to save and find a strategy that suits you! Here’s what it looks like.

- Day 1. Go without - e.g. your daily coffee, buying lunch.

- Day 2. Check in on your credit card - organise your finances to make sure you can pay your full outstanding balance to avoid paying interest.

- Day 3. Create a budget - invest the time to set up a budget template now that will save you time later, as well as money, by making it easy to track your income and expenses.

- Day 4. Set a savings goal - start your savings plan now and have the year ahead to work towards your goal. See our blog for tips to help you get started with this!

- Day 5. Review your subscriptions - see where you can consolidate or cancel your subscriptions to help you save some extra dollars.

- Day 6. Compare and Save - review your utility bills and compare plans with other providers using Beforepay’s new Compare and Save platform to see if you can potentially save by switching.

- Day 7. Sell items you don’t use or need - your trash could be someone else’s treasure, and potentially some bonus savings for you!

Want to know more about putting this into action? Check out the article.

Find out more

WE 🧡 OUR CUSTOMERS

.png)

.png?width=936&height=626&name=COL-Index-GRAPHICS%20(9).png)

.png)

.png)